missouri employer payroll tax calculator

The Form W4 Withholding wizard takes you through each step of completing the Form W4. Tax software for the tax professional.

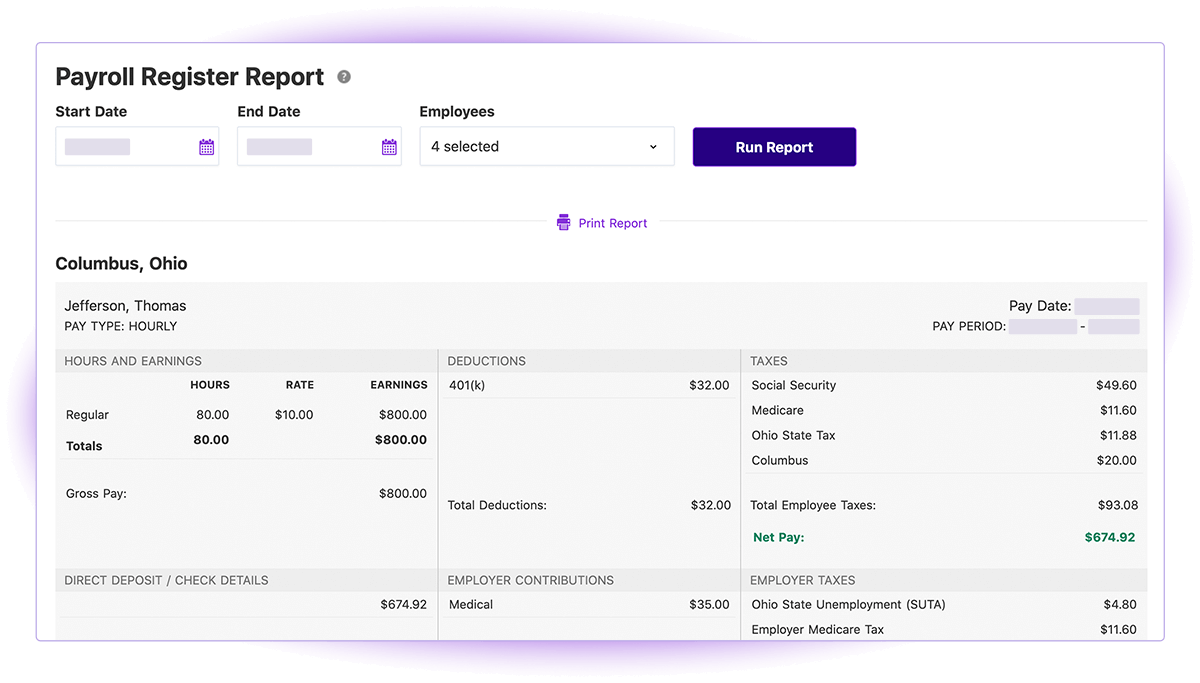

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes.

. See the Missouri Department of Revenue Missouri Employer Withholding site for questions about Missouri withholding. The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be as high as 54. Employer tax in New York employee.

Can be directed to the Benefits Specialist. Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results. The Missouri Department of Revenue Online Withholding Calculator is provided as a service for employees employers and tax professionals.

Beginning with your first payroll you must. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17. Employers can use the calculator to easily look up withholding tax rather than looking.

W-2 income. Bringing on a new employee. This calculator is for 2022 Tax Returns due in 2023.

Federal Tax Forms Click here for Federal MO Form W4P. Meaning your pay before taxes and other payroll deductions are taken out. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

A domestic employer can be sued by their worker for back wages andor be fined by their states labor agency for not following minimum wage rates. Withhold state income tax and federal income tax at a percentage determined by salary and exemption information stated on the form W-4. WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department.

2021 Tax Calculator to Estimate Your 2022 Tax Refund. Specific questions about payroll deposits participants forms etc. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri Form W-4. Get help from our experts on how to manage your household tax and payroll. The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck.

This quarterly report is required even if no wages were paid or no tax was due. Florida is unique in. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour.

Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that goes on Federal tax and New York State tax. Each quarter youll file a Form RT-6 Employers Quarterly Report to report each employees wages and the tax that is due.

Employees with multiple employers may refer to our Completing a New MO W-4 If You Have More Than One Employer example to make changes to their Missouri W-4s. This box is optional but if you had W-2 earnings you can put them in here. Single Head of Household.

Paycheck calculators Payroll tax rates Withholding forms Small business guides. Employer Contribution Limit. Payrollguru app is a paid app for Windows Phone 7.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. I just wanted to let you guys know that I really appreciate your help and your Payroll System product. I love it Sam Stacy Jr Griffin GA.

Nevada whealth benefits. The US Salary Comparison Calculator is updated for 202223 and takes into account all deductions including Marital Status Marginal Tax rate and percentages income tax calculations and thresholds incremental allowances for dependants age and disabilities Medicare Social Security and other payroll calculations. The Form W4 provides your employer with the details on how much federal and in some cases state and local.

The County Employees Retirement Fund site provides county employees of Missouri with information and references about the retirement fund and available options. Unlike your 1099 income be sure to input your gross wages. Use this employer tax calculator to get a clearer picture of the payroll taxes youll have to pay.

Its developed for business owners payroll specialist and payroll gurus that need to calculate exact payroll amounts including net pay take home amount and payroll taxes that include federal withholding medicare social security state income tax state unemployment and state disability withholding where applicable. If you found the United States Tax Calculator for 2022 useful. NY Sales Tax Preparer.

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Payroll Records What To Keep How Long To Keep Them

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Software Solution For Missouri Small Business

Employer Payroll Tax Calculator Incfile Com

Payroll Software For Small Business Patriot Software

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Payroll Tax Calculator For Employers Gusto

![]()

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Check Stub Template Printable Payroll Template Statement Template Business Template

Whose Income Is Considered When Calculating Child Support Dadsdivorce Com Ch Child Support Quotes Mo Child Support Child Support Quotes Ways To Save Money

Payroll Tax What It Is How To Calculate It Bench Accounting

Missouri Income Tax Rate And Brackets H R Block

How To Do Payroll In Excel In 7 Steps Free Template

Self Employment Ledger Forms Beautiful Self Employment Ledger Template Excel Free Download Being A Landlord Self Employment Self

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Pay Stub Template How To Create A Pay Stub Download This Pay Stub Template Now Templates Business Template Words